The industrial and logistics sector continues to be one of the most resilient performers across commercial real estate — and the momentum isn’t slowing down anytime soon.

What’s Happening

The surge of e-commerce, reshoring of supply chains, and the increasing demand for last-mile delivery facilities are driving sustained competition for industrial space. Even as other sectors soften, vacancy within industrial real estate remains relatively low, though signs of gradual moderation are beginning to appear.

Why It Matters

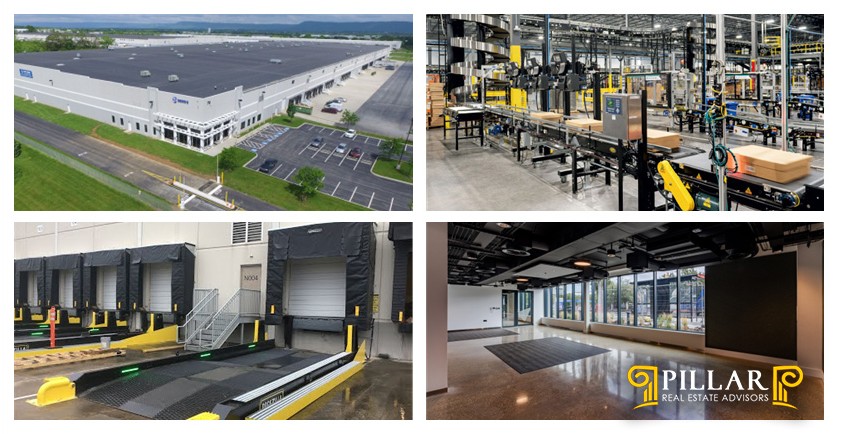

In an otherwise uncertain CRE environment, industrial assets have become a safe haven for investors and developers. But sustained success requires intention and strategy. Key criteria shaping deal-making and development include:

- Location: Proximity to transportation networks, major highways, ports, and population centers.

- Building Specifications: Clear height, loading docks, truck courts, parking ratios, and power capacity are now make-or-break features.

- Tenant Mix: Logistics, fulfillment, cold storage, and increasingly — data centers — continue to anchor demand.

Adding to the complexity are shifting supply chains, rising labor and automation costs, and climate- and regulatory-driven pressures that influence where users choose to operate and expand.

What to Watch

The next phase of industrial growth will be shaped by emerging trends such as:

💡 Last-mile hubs

Urban and near-urban facilities that bring goods closer to the consumer are expected to command premium pricing and competition.

⚙️ Automation & flexibility

Warehouses built (or upgraded) for robotics and adaptable layouts may stand out against more traditional spaces.

🔁 Repurposing industrial assets

If logistics demand shifts geographically, older industrial buildings could see renewed life through creative conversion — whether for manufacturing, flex, tech, or alternative commercial uses.