Commercial loan rates have taken a noticeable dip, creating an opportunity for investors who have been waiting for the right time to make their move. In the suburban Philadelphia metro market, where demand for certain property types has remained steady despite tighter lending over the past two years, this shift in the financial environment could reignite activity.

So, the question is: what does this mean for investors right now?

The Opportunity in Lower Rates

For much of the past 18–24 months, higher borrowing costs put a damper on commercial real estate activity. Investors who wanted to expand their portfolios or reposition assets often chose to sit on the sidelines, waiting for a more favorable rate environment. Now that banks are offering lower commercial loan rates, many see an opening to revisit acquisition and expansion plans.

“Many of our clients have been waiting on the sidelines for this,” said agents at Pillar Real Estate Advisors. “We expect them to move back into the market aggressively with this current lending environment.”

What Property Types are Seeing the Best Financing?

Not all commercial assets are treated equally in today’s lending environment. Banks are tightening their focus on property classes that show resilience and predictable returns:

- Medical Office & Healthcare Properties – With healthcare demand steady, lenders are offering competitive rates to investors looking at well-located medical office buildings.

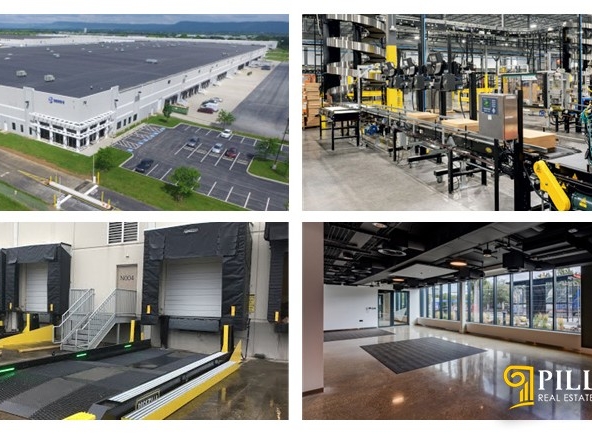

- Industrial & Flex Space – Distribution, light manufacturing, and flex properties continue to be viewed as stable, particularly in well-connected suburban corridors.

- Smaller Multi-Tenant Office Buildings – While the urban office sector struggles, suburban properties with 10,000–30,000 sq. ft. footprints are drawing attention, especially those that appeal to smaller professional tenants seeking convenience and parking.

On the other hand, retail and large traditional office towers remain more challenging in terms of financing, unless they are backed by strong tenants or unique locations.

What Investors Should Consider Now

With lower rates, competition among buyers is likely to heat up quickly, especially for stabilized, income-producing properties. Investors considering entering the market should be prepared to move decisively and have financing conversations with lenders early in the process.

For suburban Philadelphia, this could mean more activity along key corridors like Route 202, West Chester Pike, and the Main Line, where small-to-mid-size office, medical, and flex buildings remain highly sought after.

The Bottom Line

The rate environment has shifted in favor of buyers, and the suburban Philadelphia market is poised to see renewed momentum. If you’ve been holding off on acquisitions, this may be the window you’ve been waiting for.