As remote and hybrid work continue to reshape how and where people work, commercial real estate is seeing a noticeable shift away from traditional urban cores. Rising operating costs, changing workforce expectations, and evolving business strategies are prompting both occupiers and investors to look beyond major city centers. Secondary and suburban markets are gaining traction as viable alternatives, offering flexibility, accessibility, and long-term growth potential.

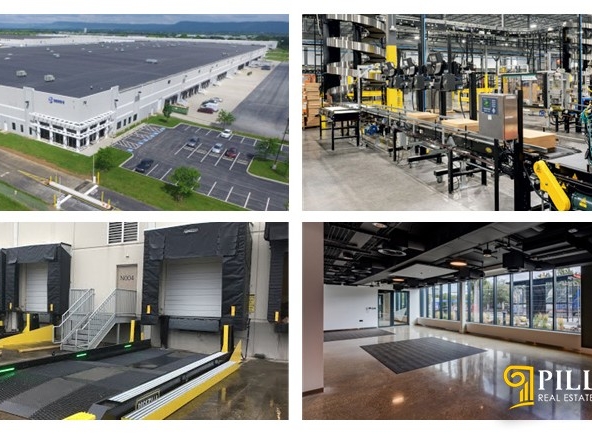

Suburban office parks, retail nodes in outer-ring communities, and markets with lower cost bases and expanding populations are attracting increased interest. These locations often provide businesses with more space, lower occupancy costs, and easier access for employees, while offering investors new opportunities outside highly competitive urban environments.

Why This Shift Matters

- Higher yield potential: Secondary and suburban markets may offer stronger returns compared to dense urban cores with compressed pricing.

- Lower barriers to entry: Reduced competition and lower acquisition costs can create more favorable investment conditions.

- Demographic tailwinds: Inward migration, population growth, and evolving lifestyle preferences are supporting demand in many of these markets.

- Operational flexibility: Tenants benefit from adaptable spaces, parking availability, and improved accessibility for hybrid workforces.

- Risk diversification: Expanding into non-core markets can help balance exposure across different geographies.

What to Watch Moving Forward

- Infrastructure and access: Strong transportation networks, nearby amenities, and access to talent remain essential for long-term success.

- Sustainable population and employment growth: Market fundamentals should support growth beyond short-term trends.

- Asset quality: Functionality, flexibility, and modern amenities continue to matter, regardless of market size.

- Differentiation risk: As interest grows, oversaturation and yield compression can follow if too many investors target the same locations.

- Local market dynamics: Understanding zoning, municipal support, and regional economic drivers is critical.