Over the past year, more employers have been calling their teams back to physical office spaces—whether full-time or through hybrid models. High-profile companies across a range of industries are emphasizing in-person collaboration once again, marking a notable shift from remote-first policies. For commercial real estate, this pivot presents both opportunity and uncertainty.

Why Employers Are Bringing Teams Back

Several key factors are driving this return-to-office movement:

- Collaboration and Culture Rebuild

Many companies believe spontaneous idea exchange and team cohesion happen more naturally in person. - Retention and Engagement

On-site work is seen as more rewarding for career growth, mentorship, and overall engagement. - Real Estate Commitments

Businesses still bound by long-term lease agreements are looking to maximize those investments by bringing employees back.

Vacancy Pressures: City vs. Suburbs

Despite the shift, downtown office vacancies remain elevated. In Center City Philadelphia, vacancy rates are still hovering around 20%—a lingering effect of the pandemic. Older mid- and B-class buildings, in particular, are increasingly being abandoned, repurposed, or left in limbo.

The suburbs aren’t immune either. Suburban office parks have reported nearly 25% vacancy, with similar challenges. However, certain submarkets are beginning to show resilience.

The “Flight to Quality”

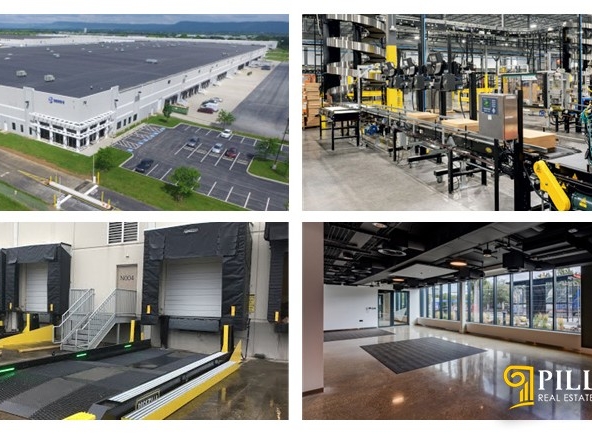

One trend is standing out: companies are gravitating toward Class A and smaller to mid-sized office spaces—those that offer:

- Modern amenities

- Flexible, efficient layouts

- Manageable footprints

This shift is helping cushion vacancy impacts in higher-quality buildings, even as outdated campuses continue to struggle.

Spotlight: Suburban Philadelphia

This trend is particularly visible in the suburban Philadelphia market, spanning Chester County through Montgomery County.

According to Pillar Real Estate Advisors, there’s increasing interest in smaller to mid-size suburban buildings, especially those that are well-appointed and amenity-rich. These properties are “showing the most activity.”

While large office parks remain in flux, landlords with flexible, updated offerings are seeing better results—higher leasing velocity, stronger renewals, and more new tenant activity.

What This Means for Vacancy Rates & Property Strategy

- Targeted Recovery

Suburban vacancy remains high overall, but select, high-quality properties are outperforming. Smaller buildings offer more adaptability and appeal. - Repurposing the Obsolete

The conversion of outdated office campuses into housing, life sciences labs, or mixed-use spaces is rising—but these projects can be complex and costly. - Investor Differentiation

Investors focusing on mid-tier suburban buildings with smart layouts, desirable amenities, and shorter lease terms are commanding stronger valuations.

Final Take

The return-to-office push marks a major inflection point for the commercial real estate market. While downtown vacancies remain high, well-positioned suburban properties—particularly Class A and smaller buildings—are seeing stabilization and renewed demand.

However, older, sprawling office parks must evolve or be repurposed to remain viable. In today’s office landscape, size, adaptability, and amenities will determine which properties rebound—and which continue to fall behind.

Key Takeaways

- Companies are increasingly asking employees to return, reactivating physical office demand.

- Center City Philadelphia still shows ~20% vacancy, while suburban Class A spaces are gaining momentum.

- Suburban Philly’s small to mid-size office buildings are attracting the most attention, according to Pillar Real Estate Advisors.

- Owners leaning into flexibility and amenity upgrades are best positioned for success.