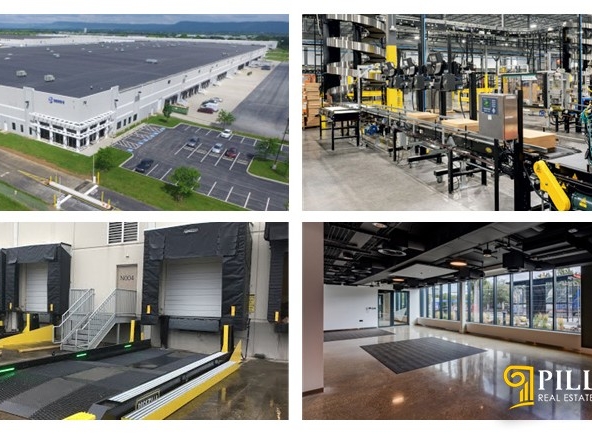

Commercial real estate is evolving, and adaptive reuse and mixed-use development are becoming key strategies for maximizing the potential of underutilized properties. Shifts in tenant expectations, rising construction costs, and a focus on sustainability are encouraging owners and investors to rethink existing assets instead of building new structures from scratch.

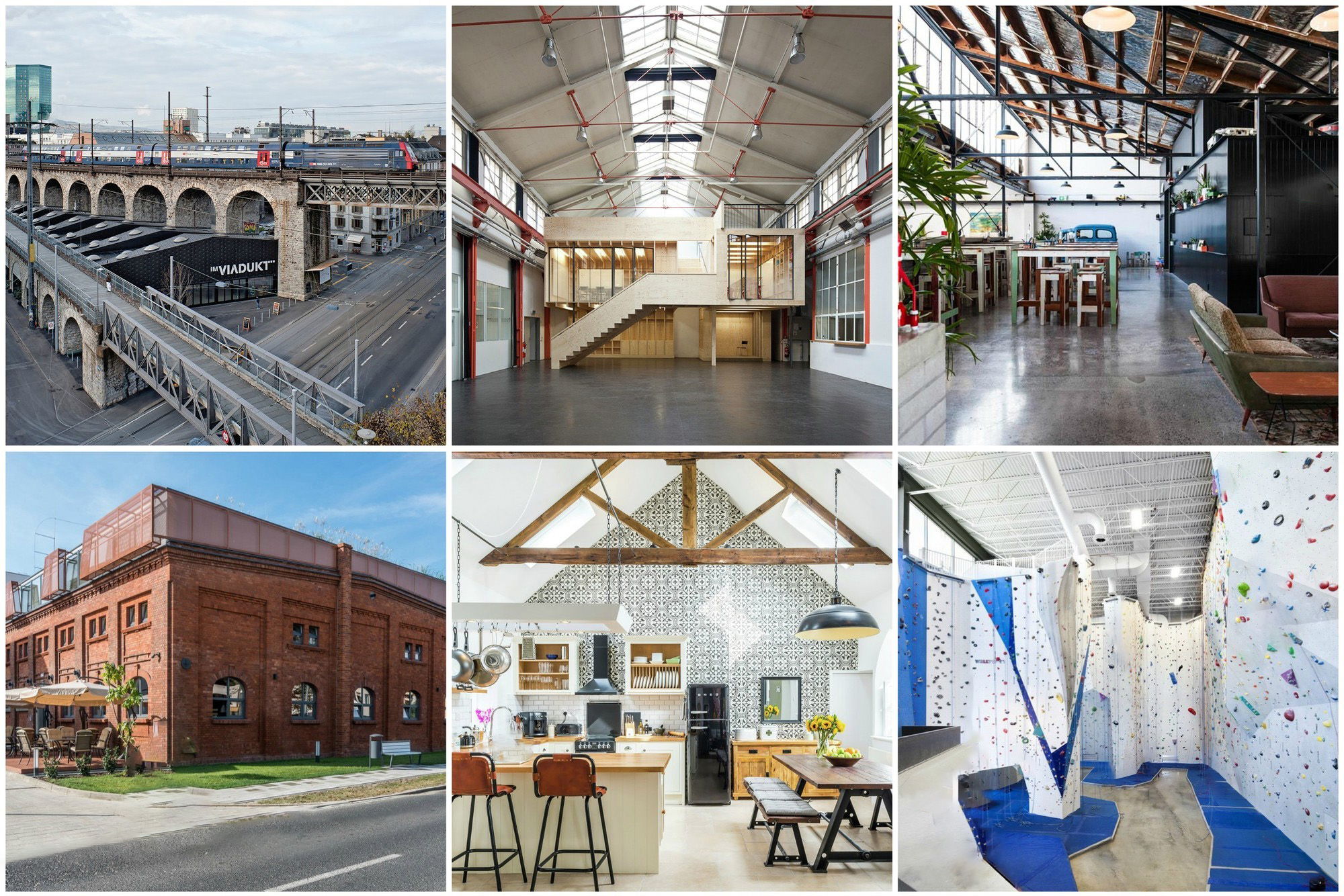

Adaptive reuse transforms older buildings into new, productive uses — for example, converting outdated offices into residential units, hospitality spaces, or medical facilities. These projects unlock value, preserve infrastructure, reduce environmental impact, and often help revitalize neighborhoods.

Mixed-use development combines residential, office, retail, and experiential spaces in a single property. These projects appeal to tenants and consumers seeking convenience, walkability, and dynamic environments. For investors, mixed-use properties provide diversified income streams and greater resilience in a changing market.

Why Adaptive Reuse & Mixed-Use Matter

- Unlock value: Transforming underperforming assets creates new revenue opportunities.

- Support sustainability: Reuse reduces construction waste and promotes responsible development.

- Adapt to demand: Mixed-use environments respond to evolving work, lifestyle, and consumer trends.

- Strengthen communities: Thoughtful redevelopment enhances neighborhoods and local economies.

- Diversify income: Multiple uses within a property help balance risk across sectors.

What to Watch Moving Forward

- Zoning and approvals: Ensure the property allows the intended uses.

- Investment requirements: Adaptive reuse and mixed-use projects often need significant upfront capital.

- Market alignment: Redevelopment should match local housing, retail, and employment demand.

- Design and structure: Existing layouts and building systems can influence cost and feasibility.

- Flexibility for the future: Properties designed to adapt remain competitive over time.